The brilliance of billionaires is not something I've ever held with. Their backstories are usually one of generously-provided start up capital, usually from the bank of well-to-do mum and dad, luck and timing mistaken for business acumen, and more often than not big state contracts and plenty of fictitious capital. This week, for example, we've seen the aptly-named Sam Bankman-Fried's crypto currency-derived billions simply vanish - a whole lot of money that, it turned out, didn't really exist. Similarly, the same can be said for Elon Musk. Reputed to be worth over $200bn, he still had to scrape together IOUs from banks, the Gulf's absolutist sheikdoms and various odds and sods, including Bankman-Fried, to finance his $44bn purchase of Twitter. And what has Musk done with his new plaything? He's completely trashed the platform's commercial value, and made himself look like an utter fool.

Unlike Meta and Google who have a strong business model based around the harvesting of data and using this to sell advertising, since its inception Twitter has proven much more difficult to monetise. If one's Twitter feed is cluttered with too many adverts, the platform's utility declines. And given the proliferation of apps through which Twitter can be viewed, it's a lot more difficult to bring in the commercial megabucks its peers enjoy. In 2020-21 it achieved an all-time revenue high of $5bn, but still posted a net loss of $221m. Reversing this appears to be Musk's priority to the exclusion of all else, and so within a week of his taking over he fired practically all the executive team and made approximately half of Twitter's staff redundant - leaving the company open to legal action outside the United States for violating local redundancy laws. Contrary to his cool techbro image, Musk also ordered the remaining staff back to the offices, a demand that has gone down as well as the fail whale did with old-time Twitter users. And Musk decided to "innovate". Claiming the mantle of man of the people, Musk said he was now charging verified accounts - the famous blue ticks - $8/month for the privilege of the badge. It has proved to be a disaster.

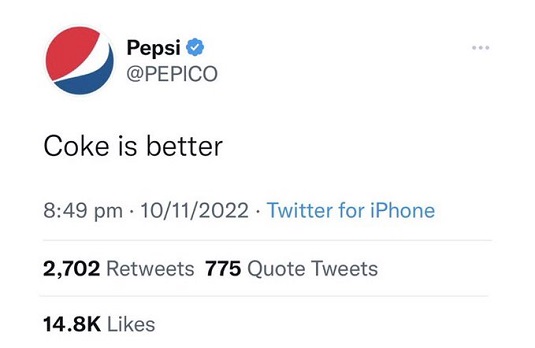

The arrival of the blue tick of verification did, at least for some Twitter users, signify a two-tier system. It awarded status to those upon whom it was conferred. However, the advantage of the system was that it verified the user. If, for example, the blue ticked Downing Street account tweeted something then it was official, not some impersonator. By introducing verification by payment, Musk at a stroke removed the only mark of trust the platform offered. For example, a blue ticked feed purporting to be Eli Lily and Company, a US pharmaceutical giant, announced it was making its insulin products free. That wiped $20bn off the firm's stock market value. Lockheed Martin was also stung by a similar prank, announcing sales to Saudi Arabia, Israel, and the United States would be suspended pending human rights abuse investigations. Their share price dropped 5.5%. It's a wonder these firms haven't launched action against Musk for damages done around trade mark infringement. Whatever, it will certainly put off further corporate engagement with Twitter as they try and protect their brand image. And the effect it will have on advertising can only make a bad situation worse.

How to explain this colossal idiocy? It demonstrates Musk's gargantuan arrogance and belief in his own Midas touch. There are no 11 dimensional reasons why he's trashed its primary revenue stream. He's not doing a solid for the Saudis and Qataris who part-financed his purchase. He's not wrecking the site because of secret deals done with other social media platforms. It's entirely a wrong decision driven by hubris and not having anyone around him who'll say no. In short, he is to Twitter what Liz Truss was for the UK economy and the Conservative Party. After 48 hours, the paid for blue tick scheme was abandoned but that's unlikely to reverse the damage to Musk's reputation. It makes you wonder how well SpaceX would manage if it wasn't propped up by US Space Force and NASA cash.

Unfortunately, while Musk will survive his humiliation to make another spectacle of himself the future of Twitter itself is less certain. Having already loaded the company with a billion dollars worth of debt, the public failure of his revenue generating scheme and sharp decline in advertisers could well bankrupt the company. And this would be an outrage. Twitter has all kinds of problems, but like other platforms it has become essential infrastructure. It is next to impossible to follow politics in this country without Twitter. It's where stories are broken, analyses are shared, and politicians get a measure of daily accountability. It's space where it is still possible to report on news the mainstream refuse to pick up and can be kept alive. Serendipitous connections are forged with every moment, and unlike other algorithm-heavy sections of the internet there's still a good chance of finding something random and interesting. More importantly, despite efforts by sundry dictatorships Twitter is the main method of getting reports and video out of closed societies and get the information quickly disseminated. There is no other place like it, and despite its regular descent into bad faith, ad hominem, and ridiculous wars over petty slights, politics and democracy would be the poorer for it.

Musk's antics reiterate the need for removing social media from private hands. Communication is the lifeblood of the common, and only common ownership will do.

2 comments:

Elon Musk's entire , extraordinary, business career is one of the best examples ever of the con man and busker Ponzi scheme operator as 'businessman, fooling the ever-gullible global investment market into supporting ventures which are based on total media-supported hype. That his, never consistently profitable, Tesla electric car business is worth more in capitalisation than the largest car producer in the world, Toyota, with a tiny actual output compared to Toyota, tells you a lot about the utter irrationality of today's global capitalism.

Last year the only 'profit' Tesla made was from Musk's 'ramping' up of the value of his huge Bitcoin holdings via social media, and then selling them again at a huge profit ! Not from car production. The global crisis of capitalist profit rates (as opposed to the mass of profits), and the resulting diversion of so much investment capital into 'fictional profit generation' through financial spivery and the destructive asset stripping of productive industries (capitalism eating itself), has made investors hugely vulnerable to the endless hype that a fairground barker con man like Elon Musk has created via a compliant, non investigative, mass media.

All so reminiscent of the gigantic Bernie Madoff investment Ponzi scheme . Eventually Musk's con trick stage show will collapse, and his disastrous Twitter purchase may soon show (in Warren Buffet's words) that he was 'swimming without his trunks on' all the time ! And when Musk's huge business Ponzi scheme goes inevitably go down in flames, it will disrupt investment markets globally, such is the scale of the money unwisely invested in his con trick business empire. The only bit of his empire that seems really profitable is the low orbit satellite bit, and that is now heavily subsidised by the Pentagon, to provide the Ukrainian forces with non-interceptable communications ! The military industrial complex writ large.

As another very current example of Phil's all too accurate observation on the hubris and hype around the supposed 'masters of the universe' big idea current high profile billionaires , like the con man, Musk, the current growing collapse of that classic 'Dutch tulip bulb frenzy-type Ponzi Scheme' con trick, ie, the cryptocurrency scam, provides another proof of the irrationality of current , 'fictitious profits from financial chicanery' capitalism. Have a read of the excellent article in today's Guardian, in the Opinion section, by Molly White, on the collapse almost overnight of the previously thought utterly solid FTX cryptocurrency exchange run by its Elon Musk-like, billionaire con man owner, Bankman-fried - in the article 'Why did one of the world's biggest cryptocurrency exchanges just collapse ?'

It turned out the entire supposed utterly secure balance sheet of FTX was a fraudulent concoction , and so interlinked are the equally fraudulent balance sheets of the rest of the globe's cryptocurrency exchanges, that the whole house of cards of cryptocurrency is likely to collapse, 2008 banking crisis domino effect-style, in the next few months. And it is the UK as a cryptocurrency hub , in addition to endless tax-free , regulation-free 'freeports, that are our new ex hedge fund Prime Minister's 'Big Ideas' for rebuilding the UK economy !!!

Post a Comment