In and around North Staffordshire on the evening on Monday 20th January, around the 7pm mark?

Wondered why, over a decade ago, a crisis in the American housing market spiralled out and brought the world's financial system to its knees?

Tried making sense of it all but find the jargon around equities, securitised mortgages, and collateralised debt obligations completely off-putting?

And how we can avoid a crisis of this magnitude in the future?

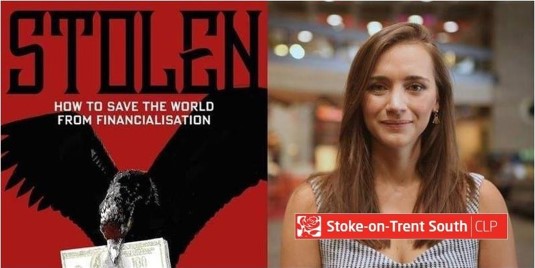

Grace Blakeley, author of the excellent Stolen: How to Save the World from Financialisation will be in conversation with some bloke called Phil Burton-Cartledge to make sense of the crisis, what it has to do with Thatcherism, how the Tories were able to use it to justify their decade-long programme of cuts, and why democratic socialism is the answer.

Hosted by Stoke-on-Trent South Labour Party, attendance is free but you will need to register. You can do so via Eventbrite here. And our evening takes place at

Fenton Town Hall

Stoke-on-Trent

ST4 3BX

There will be copies of Grace's book going for the cheaper price of £10 on the night. It comes highly recommended!

8 comments:

Hope the event will be recorded and made available in some form.

The problem with left liberal/Keynesian accounts of financialisation is that they draw a line in history that implies all was well before 1973 (or thereabouts) until a series of contingent events brought the "Keynesian Golden Age" to an avoidable end.

For those who take this view the political task for the left is to develop a new set of Keynesian-type institutions to once again subordinate finance to the real economy.

The Marxist view is that financialisation has been a response to a crisis of global over-accumulation that Keynesianism was unable to resolve. The political task for the left is to transcend the forms of production relations that give rise to crises of over-accumulation - which are the drivers of the increased use of credit/debt to sustain accumulation.

For some financialisation is a deviation within modern capitalism, while for others it is modern capitalism.

Having heard Grace talk about her book several times, her view seems to oscillate between the former and latter. In the context of Labour Party politics and policy, emphasis is placed on a revitalised Keynesianism with new regulations etc. When pushed by more critical interviewers, she acknowledges the roots of financialisation in the essence of capitalism itself.

Would be interested to hear more on that.

Mike

Her incoherence on the roots of financialisation under capitalism is entirely consistent with her essentially left-reformist pro-Brexit stance.

As opposed to Jim Denham's pro imperialist, pro neo liberal and anti working class bourgeois uber economic nationalism.

Every Marxist has an incoherence in their view of financialisation and its causes, anyone claiming they have a coherent theory, free of problems is either a liar or an idiot. I am not sure which it is with Denham!

Here is a good debate among Marxists on the issue, note the incoherence and the differences among the speakers:

https://marxismocritico.com/2014/11/21/the-great-meltdown-of-2008/

Financialisation is concept still being grappled with, and it will be for some time to come.

“The Marxist view is that financialisation has been a response to a crisis of global over-accumulation that Keynesianism was unable to resolve.”

It may be the view of some Marxists, but by no means all, or even a majority. If it were true then it implies that that crisis of over-accumulation was more or less permanent, i.e. that when it arose in the mid 1970's, Keynesianism having been unable to resolve it led to financialisation as a means to do so, and that financialisation has continued to today. But, such a perspective is inconsistent with Marx, who says “There are no permanent crises” (Theories of Surplus Value, Ch. 17)

Marx's theory of crises of over-accumulation/overproduction of capital, is that it arises where capital accumulates faster than the labour supply, so that first absolute surplus value cannot be expanded enough (relative over production) or at all (absolute overproduction), and where then a relative labour shortage causes wages to rise so that not only is it impossible to raise relative surplus value, but it falls due to rsing wages squeezing profits.

“As soon as capital would, therefore, have grown in such a ratio to the labouring population that neither the absolute working-time supplied by this population, nor the relative surplus working-time, could be expanded any further (this last would not be feasible at any rate in the case when the demand for labour were so strong that there were a tendency for wages to rise); at a point, therefore, when the increased capital produced just as much, or even less, surplus-value than it did before its increase, there would be absolute over-production of capital;” (Capital III, Ch. 15)

The means of resolving such a crisis is by a technological revolution. That means that as productivity rises, a relative surplus population is created. That means wages that have risen above their value fall back, removing the squeeze on profits. It means the value of labour-power itself falls as productivity cheapens wage goods, so wages fall further, raising the rate of relative surplus value. Rising productivity reduces the value of constant capital. The existing Fixed capital stock becomes significantly depreciated, the value of materials falls. A higher rate of surplus value, plus a lower value of capital raises the rate of profit. The reduction in the value of the components of capital creates a large release of capital as revenue, which is available for accumulation. It creates the conditions for the following expansion.

The period of such technological innovation occurred in the late 70's and early 80's. The introduction of these new technologies based around the microchip proceeds during the 1980's and 90's, leading to a higher rate and mass of profit during that period, which creates the conditions for the new expansion that began in 1999.

As Marx explains, when such introduction of new technologies acts to raise the rate and mass of profit, the associated consequence is to increase the mass of available money-capital form realised profits relative to the demand for that money-capital. The period is characterised by slower, and even stagnant growth, characterised, Marx says, by net output expanding at a faster rate than gross output. The consequence is that interest rates fall. That is what we saw from around 1982. Falling interest rates cause rising asset prices, which is what we saw in the 1980's and 90's. In other words, financialisation was not a response to a global overproduction of capital, but was the consequence of the solution to that crisis, via the normal raising of the rate of profit via the raising of productivity by a technological revolution.

Cont'd

Cont'd

The massive rise in asset prices be they house prices, or shares and bonds and derivatives of them, meant that the owners of these assets became deluded that it represented a real increase in their wealth. Practically, that is how it seemed. If you owned a house, its rising price meant you could remortgage and use the borrowed money to buy additional consumables. If you owned shares, bonds or mutual funds, you could take the large capital gains they offered and convert them into revenue to spend. If you were a pension fund, you could ignore the fact that the actual revenue produced from dividends, and interest was not rising quickly, and the yield was declining, by fooling yourself that you could instead likewise liquidate capital gains, and use that to pay out pensions. If you were the government, you could likewise delude yourself into the belief that these capital gains represented real increases in wealth that could be liquidated to finance government spending, to have consumers finance their consumption rather than by rising wages, and that they could finance their retirement or elderly social care out of the inflated price of houses etc.

For the top 0.01% who now own all their wealth in the form of such assets, it became decisive. Why worry that the yield on shares has fallen to next to nothing if the share price rises by 30,40,60% a year, enabling you also to just sell a few of them, and liquidate vast amounts of capital gain instead. Speculators bought property to get these capital gains. Properties were left empty, because speculators were not interested in relatively low rental yields, when they thought the price of the property would rise by 20% and more each year. In 2017, the Austrian government issued a 100 year bond paying just 2% interest, essentially 0% in real terms. It was snapped up, and since issue, it has risen in value by 60%.

The top 0.1% who now own their wealth in the form of these assets (fictitious capital) became dependent on continued rises in the price of these assets. But, the price of such assets can only sustainably rise if profits rise, because interest and rent is a deduction from profit. But profit can only rise if more productive capital is employed, so that more labour is employed, which produces more surplus value. If profits start to rise at a slower rate, then capital can only continue to be accumulated at the same pace if more profit is devoted to it, and less to paying rent and interest. Less profit is thrown into money markets, but some capitals need to borrow to invest, so the demand for money-capital rises relative to supply, and interest rates rise. When interest rates rise, asset prices fall. When asset prices fall the wealth of the top 0.01% falls, and that affects their power and status.

Cont'd

Cont'd

So, the representatives of the top 0.01% on company boards, instead ensured that dividends were maintained. In the 1970's 10% of profits went to dividends, today its 70%. But, that exaggerates the problem. Less profits devoted to capital accumulation, means lower future profits, which means greater problems sustaining rents and interest, which means less basis to sustain inflated asset prices. So, the only way around that is for the state via the central bank to buy up the worthless assets. QE buys up bonds, pushing their price higher. Companies issue additional bonds, and use the money to buy up shares, which inflates share prices. States bail out banks, and buy up worthless mortgages, and intervene to provide cheap loans etc. for property purchase so as inflate house prices. At the same time this has the effect of starving funds for real investment. Small and medium firms cannot get loans, or have to go to peer to peer lenders charging 10%, or else use personal credit cards, consumers rely on credit card, and store card debt with rates up to 30%, or even payday lenders charging 4000%.

But, all that simply diverts an increasing amount of money and money-capital away from real capital accumulation and from the real economy, so as to engage in this speculation. In doing so it makes the problem worse, and makes a larger crash in asset prices inevitable. In order to try to prevent interest rates rising, the state imposes austerity to reduce economic growth, which is what has been seen since 2010. But, the fundamental laws of capital mean that ultimately expansion of employment causes the demand for wage goods to rise so that firms have to increase output, which especially with low levels of productivity growth, means employment increases further, so that demand rises further and so on. Inevitably interest rates rise, and asset prices crash.

Well, I attended, and learned a lot!

I look forward to more of the same kind of event, and congratulate all involved.

Thanks Karl, glad you enjoyed!

Post a Comment